With Tax Compliance being on track and Accounting on point , you can now spend your time taking up things which were earlier not in order due to fussy compliance and accounting routine.

Generate Invoices in less than 60 seconds, track invoice payments and follow-up automatically.

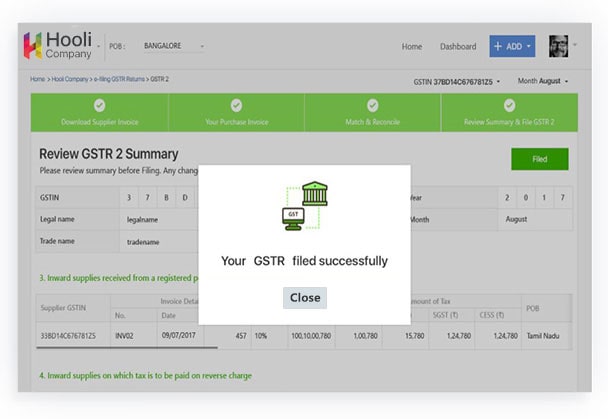

File GSTR1 to GSTR9 from a single platform; Validate errors and identify mismatches before all submissions.

Auto verification of Consignee GSTIN while generating EWB

Auto verification of Consignee GSTIN while generating EWB

No manual data entry required. Import and export all data from/to existing accounting software with just a click of a button.

Stuck anywhere? Our support team is steadfastly available to help you get through. Our success emanates from your success.

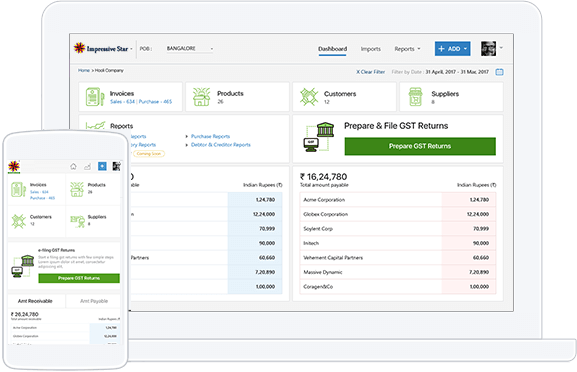

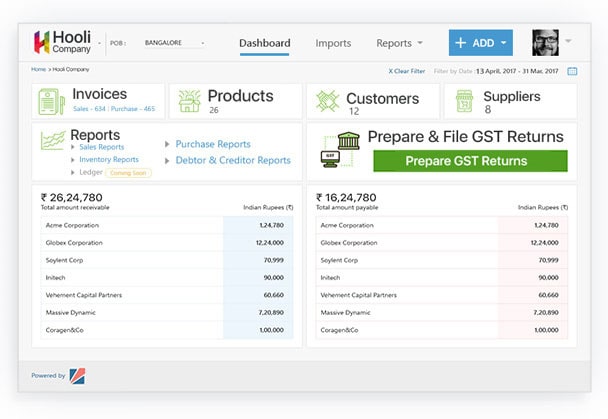

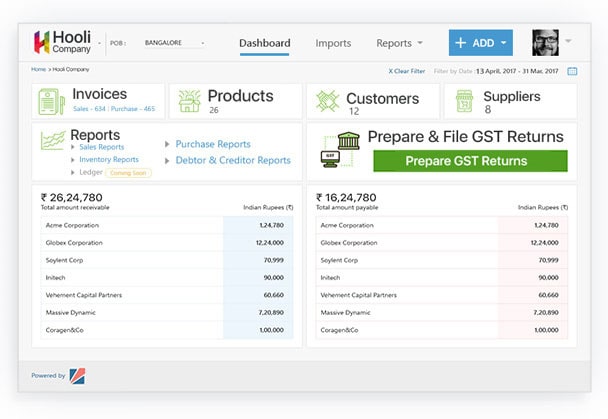

Manage All Clients Easily At One Place. Avoid Errors & Save Time.

Do Error-free Invoicing & Return Filing In Minutes.

GST rules specify that each invoice of a business should contain certain fields like HSN/SAC code, tax split between IGST, CGST, SGST and UGST, vendor/purchaser GSTIN etc. With KDK GST software, generate GST compliant invoices customised with your business logo, for each place of business within 60 seconds. Maintain all vendor and client contacts, keep track of pending invoice payments and reconcile them.

With many changes to how businesses account for their purchases sales and calculation of input tax credits, GST software makes it easy and fast for your business in transition to being fully GST compliant. Explore more features of KDK GST Software below that makes GST compliance easy.

GST laws require timely filing of GST returns monthly, quarterly and annually. With KDK GST software, file all your returns from GSTR1 to GSTR9 on time and accurately. Generate completed returns by importing data from your existing software, excel or invoices generated within the KDK GST software, reconcile the invoices, validate the taxes, push to GSTN and eSign returns from the KDK GST software.

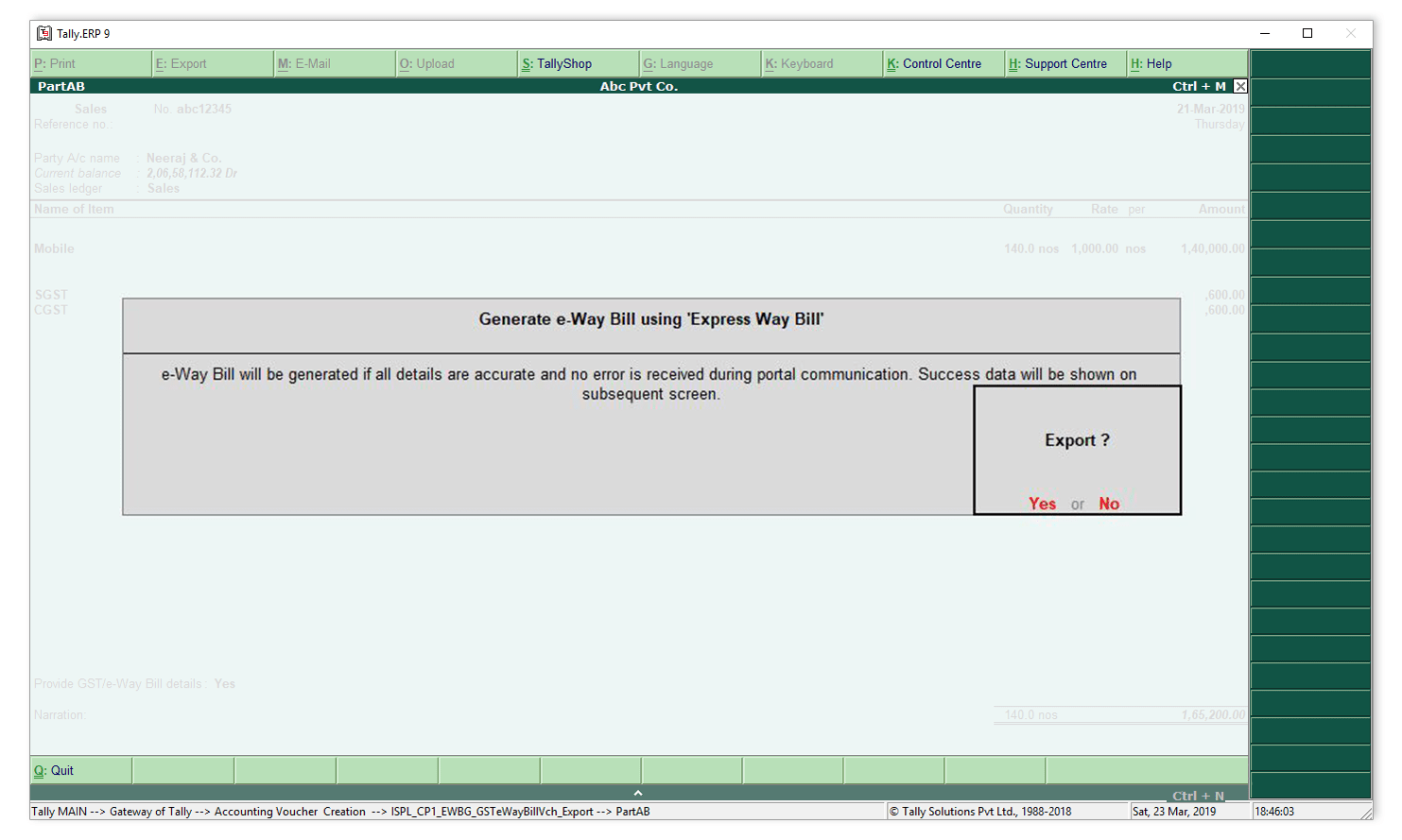

Do you transport goods within your state or across different states in India? To comply with the GST law, you will need a new electronic document in order to transport your goods – the E-Way Bill. Normally, to generate E-way bill through Government portal you need to follow a series of manual and time-taking steps. With the Express Way Bill Software, you can compress all of the steps required for generating an E-way bill into one single step: generating your E-Way bill directly from Tally in 1 second.

Auto-populate HSN & SAC code on the invoices with simple product/service name search option.

Auto-calculation of the CGST, SGST IGST, UGST and Compensation Cess amounts based on your product or service and the data provided and apply them to the invoice.

Generate unique and customised invoices for each place of business under a single GSTIN. Apply taxes based on place of business and supply rules

Invoice upload, Reconcile, eSign and submit all GSTRs from GSTR1 to GSTR9 to GSTN with secured GST APIs.

No manual data entry required. Import and export all data from/to existing accounting software in just a click of a button.

Calculate accurate ITCs with invoice reconciliation and vendor management. KDK GST Software will calculate the ITCs with matched, recognised invoices.

Import data from existing accounting software, export data to other ERPs, excel or other desired formats with a single click

File all returns - GSTR1 to GSTR9 from a single dashboard without navigation hassles.

Generate tax reports, financial reports, top vendor reports, top clients report and many more in multiple formats at just a click of a button

EWB generation in 1 second from your accounting ERP

Get E-Way Bill No. directly and print EWB.

Smart Validations for 99.99% Error Free Outputs

Get a EWB download link on email and SMS.

No charges for failed API attempts/Non-EWB generation API, Pay only for successful EWB generation

Bulk E Way Bill Generation & Quick Cancellation